📅 What the December 19 USDA Cattle on Feed (COF) report will cover

USDA‑NASS typically publishes COF on the third Friday of each month. The December 19 report will show feedlot inventories as of December 1, plus November placements, marketings, and other disappearance for 1,000+ head lots across the 16 largest feeding states. [nass.usda.gov]

🔢 My detailed pre‑report prediction (ranges + point estimates)

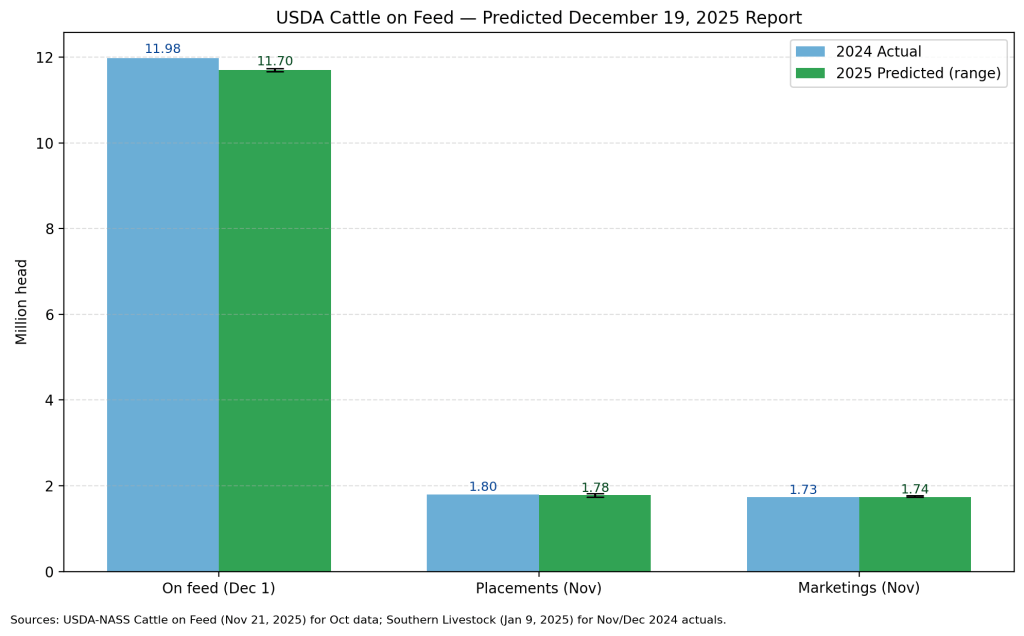

Headline (U.S. total, 1,000+ head lots):

- On feed, Dec 1: 11.66–11.74 million head (point estimate: 11.70 million; ≈ –1% to –2% YoY).

Basis: November 1 was 11.706 million; tight feeder supplies and modestly lower net inflows suggest another small drawdown into December. [esmis.nal.usda.gov] - Placements (Nov): 1.74–1.82 million head (point: 1.78 million; ≈ –6% to –12% YoY).

Basis: The Mexico feeder import halt has constrained fall inflows; October placements were already down 10% YoY to 2.039 million, the lowest October on record. With seasonally smaller November placements, another decline is likely. [fb.org], [esmis.nal.usda.gov] - Marketings (Nov): 1.73–1.77 million head (point: 1.74 million; ≈ –1% to –4% YoY).

Basis: October marketings were 1.697 million (–8% YoY), and while weekly slaughter briefly ramped early December, November’s full‑month marketings likely stayed below last year given tighter front‑end supplies. [esmis.nal.usda.gov], [cattlerepo…center.com] - Other disappearance (Nov): 50–60 thousand head (point: 55k), in line with recent months. [esmis.nal.usda.gov]

Arithmetic check (point estimates):

Dec 1 on‑feed ≈ 11.706 + 1.780 – 1.740 – 0.055 = 11.691 million head, rounded to ~11.69–11.70 million. [esmis.nal.usda.gov]

🧠 Why these numbers make sense (drivers & context)

1) Tight feeder supplies, especially in the Southwest

US feeder cattle imports from Mexico remain sharply constrained due to New World screwworm restrictions, materially reducing placements in border‑adjacent feeding regions and contributing to the Texas/Nebraska on‑feed shift seen in November. Expect that to persist in December. [fb.org], [extension….sstate.edu]

- In the November COF, Texas fell ~9% YoY to 2.63 million, while Nebraska hit a record 2.64 million, overtaking Texas. The same structural constraints imply continued relative strength in Nebraska vs. Texas into December. [beefweb.com]

2) Recent COF trend is lower placements/marketings

The November 1 report showed on‑feed 11.706 million (–2% YoY), October placements 2.039 million (–10%), and October marketings 1.697 million (–8%)—consistent with smaller calf crops and constrained inflows. November should echo that pattern at slightly smaller absolute levels. [esmis.nal.usda.gov]

3) Packer capacity headlines don’t change the November math

Tyson’s Lexington closure (effective early 2026) and Amarillo shift reduction are a big story for forward capacity/competition, but they do not reduce November marketings captured in the December COF. Near‑term, those moves temper the price outlook and could cap futures’ response to bullish supply prints. [bloomberg.com], [amarillo.com], [cattlerange.com]

4) Slaughter cadence vs. calendar

Early December saw a weekly slaughter spike (~600k head), but the December COF reports November flows. While packers pulled harder as margins improved, the November total looks below year‑ago given the 12‑month downtrend in feedlot inventories. [cattlerepo…center.com], [farmprogress.com]

📦 Placement weight mix & heifers (what to look for)

- Weights: Expect a relatively heavier skew (700–899 lb) in November placements compared with deep‑fall history, as fewer light calves are available. For reference, October’s distribution was 515k (<600 lb), 420k (600–699), 445k (700–799), 384k (800–899), 195k (900–999), 80k (1000+)—November should be the same shape at lower totals. [esmis.nal.usda.gov]

- Heifers: The steer/heifer split is formally reported quarterly (next in January). Recent analysis shows fewer heifers on feed YoY largely because Mexican spayed heifers vanished from the pipeline after the border closures—not a definitive sign of aggressive domestic heifer retention. Keep that nuance in mind when interpreting January’s ratios. [southernagtoday.org], [cattlerange.com]

🧭 Likely market reaction (base case)

- Futures: A modestly bullish knee‑jerk (tight supplies), tempered by the 2026 packer capacity narrative and USDA’s lowered price outlook through 2026 in WASDE. Expect choppy trade with deferreds lagging if traders view capacity cuts as demand‑side headwinds for cattle prices. [bloomberg.com]

- Cash: Firm to slightly higher where negotiated trade can clear; regional spreads may widen with Nebraska/Iowa stronger than Texas/Kansas if on‑feed dispersion persists. [beefweb.com]

- Boxes & kill: Short holiday weeks will mute late‑December slaughter, but early January data will start reflecting packer network adjustments. [cattlerepo…center.com]

🎯 Trader’s checklist for December 19 (Plains People style)

- Pre‑position sizing: Keep risk light into the print; widen stops around the release window. Volatility clusters around COF drops.

- What matters most: Placements vs. last year and Dec 1 on‑feed—anything near the low end of the ranges above is bullish.

- Regional basis: Nebraska‑centric strength vs. Texas—check your packer bids accordingly. [beefweb.com]

- Forward curves: If the report prints tight, look for front‑month support; but don’t ignore the capacity story capping deferreds. [bloomberg.com]

- Next catalyst: January COF (quarterly steer/heifer) + Jan 31 cattle inventory—key for heifer retention signals and 2026 calf crop expectations. [nass.usda.gov]

What’s shown

- On feed (Dec 1, 2025) — Predicted: 11.70 M head

Range: 11.66–11.74 M - Placements (Nov 2025) — Predicted: 1.78 M head

Range: 1.74–1.82 M - Marketings (Nov 2025) — Predicted: 1.74 M head

Range: 1.73–1.77 M - 2024 comparison (Dec 2024/Nov 2024 actuals):

On feed 11.98 M, Placements 1.80 M, Marketings 1.73 M [us-prod.as…rosoft.com]

Sources & basis

- USDA-NASS COF (Nov 21, 2025) for latest verified October and November 1 figures (on-feed 11.706 M; October placements down 10%; October marketings down 8%). These anchor the trajectory into December. [cfbf.com]

- Southern Livestock (Jan 9, 2025) for Nov/Dec 2024 actuals used as comparison bars (Dec 1 on-feed 11.98 M; Nov placements 1.80 M; Nov marketings 1.73 M). [us-prod.as…rosoft.com]

- Constraints on Mexican feeder imports (New World screwworm restrictions) inform the tighter placements outlook. [rfdtv.com], [producer.com]

Leave a comment